If you have been following cryptocurrencies, NFTs, or anything web3 over the past two years, you likely have heard the term Decentralized Finance, or “DeFi” for short. DeFi is one of the most exciting aspects of blockchain technology. Many say that our modern financial system will adopt many aspects of DeFi. However, for beginners, Decentralized Finance can seem like a complex world that is not friendly to crypto amateurs.

In this guide, we will go over what DeFi is, what the biggest projects are in the space, and how you can begin investing.

What is Decentralized Finance?

At its most basic level, Decentralized Finance (DeFi) is a financial system that gives users access to capital without the need for a central authority or intermediary. For example, with DeFi a user can take out a loan without the need of a lender or a bank. The entire transaction is on and verified by the blockchain.

The blockchain is a public and secure ledger of transactions. Each transaction creates a new entry (block) on the public ledger (chain), which is monitored and verified by the community. These entries are encrypted with cryptography, and cannot be forged. Since it is decentralized technology, one singular player cannot make changes to the blockchain.

Blockchain technology is the basis of all cryptocurrencies, however it also is the base technology for all Decentralized Finance Apps, or “dApps” for short.

What is a dApp?

Decentralized Apps, or dApps, are the protocols and programs that make up the DeFi space. A dApp is created by leveraging blockchain technology called smart contracts. Smart contracts enable DeFi applications to function without a central authority overseeing the transaction.

For example, traditionally when buying a home, there is an Escrow agent that ensures that the buyer transfers funds in a timely manner to the seller. However, using DeFi, there would be no need for an Escrow agent. The smart contract would not release funds to the seller until a certain condition was met. This would be programmed into smart contract.

This technology is extremely powerful, and it is changing the financial landscape.

What are the Uses of DeFi?

The primary uses of DeFi involve Peer to Peer (P2P) transactions. P2P transactions involve two parties exchanging cryptocurrency for a good, a service, or a different cryptocurrency. P2P is the basis of all of DeFi, and they come in many different forms.

How to Lend and Borrow Money Using DeFi

One of the most popular ways DeFi is used today is through lending protocols. If you have cryptocurrency that you would like to lend, you can deposit your currency into a liquidity pool and earn interest. Interest rates vary across different DeFi apps, however some protocols are known to give upwards of 15%+ for deposited cryptocurrency.

If you would like to borrow money, you simply need a compatible wallet and some cryptocurrency to put up as collateral. Once you connect to the DeFi App using your wallet, you can deposit your cryptocurrency as collateral and receive a different crypto in return. In order to retrieve your collateral, you must repay your loan. However, by using DeFi loans, you can borrow money without any credit checks or personal information requests. You simply need a wallet and some cryptocurrency.

What is Yield Farming?

Yield Farming in DeFi is when you lock your cryptocurrency into a pool for a specific amount of time and earn interest on those tokens. This forms a liquidity pool which is then used by the DeFi application to lend money to other users. In recent years Yield Farming has become extremely popular, partly due to the very high rates that were being earned from some protocols.

Some of the most popular DeFi protocols to Yield Farm are Aave, Curve, and Uniswap.

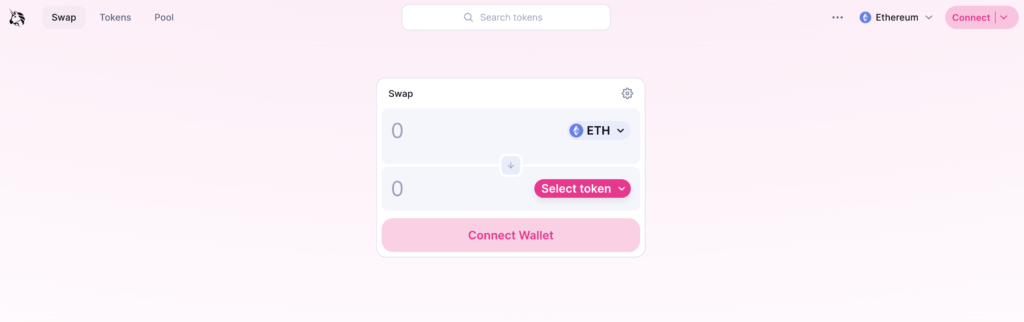

How to Swap Cryptocurrencies Using DeFi

One of DeFi’s more prominent uses are swapping cryptocurrencies through Decentralized Exchanges (DEXs). Not to be confused with centralized exchanges, like Binance or Coinbase- DEXs use smart contracts and liquidity pools to facilitate the buying and selling of crypto in a peer to peer setting. In a centralized exchange, the exchange itself is the market maker and connects buyers and sellers. A DEX is an automatic market maker, so there is no need for a central authority to facilitate transactions.

In the wake of many centralized exchanges facing liquidity crunches, the advantages of using a DEX is starting to show. While DEXs often charge more network fees to use (as opposed to centralized exchanges), they are far more transparent, and your coins always remain in your possession.

The Future of DeFi

Decentralized Finance is still in its infancy. While there are growing pains around Decentralized Finance, the technology continues to be adopted by major players, such as JP Morgan. Mainstream adoption will be driven by investments from large organizations, and from there the technology will only continue to improve.